- Published on

Investing in the S&P 500 versus a savings account

S&P 500 versus a savings account

I often have people ask, "What is the best way to invest my money?" and my answer is always the same.

"Invest in the S&P 500."

Before you start investing

Before you start investing, you should make sure you have a few things in order:

1. You have paid off any high interest debt

It is crucial to address any high-interest debt, such as credit card balances or student loans. Such debts often carry interest rates significantly higher than the average returns you can expect from investments.

Paying off these obligations not only frees up cash flow but also reduces financial stress.

2. You have an emergency fund

If you don't have an emergency fund, you should start by saving up a few months worth of expenses. Most people recommend 3-6 months but I would encourage a years worth if possible.

This will help you avoid having to sell your investments at a loss if you run into financial trouble.

Having such a fund is a privilege that not everyone has, but if you can, it's a good idea to have one.

Why the S&P 500?

The S&P 500 (Standard and Poor's 500) is a great and relatively secure place to start investing as it is a diversified index of the 500 largest companies in the United States.

This means that you are investing in a broad range of companies, which helps reduce risk, especially when compared to investing in a single company.

Also and perhaps most important, the S&P 500 is famously known for its consistent returns over the long term. Over the last 30 years the S&P 500 has returned an average of ~9.7% per year (~7.4 adjusted for inflation).

This is much higher than the average savings account (returns ~1-2% per year) or high yield savings account (returns ~3-5% per year).

Example

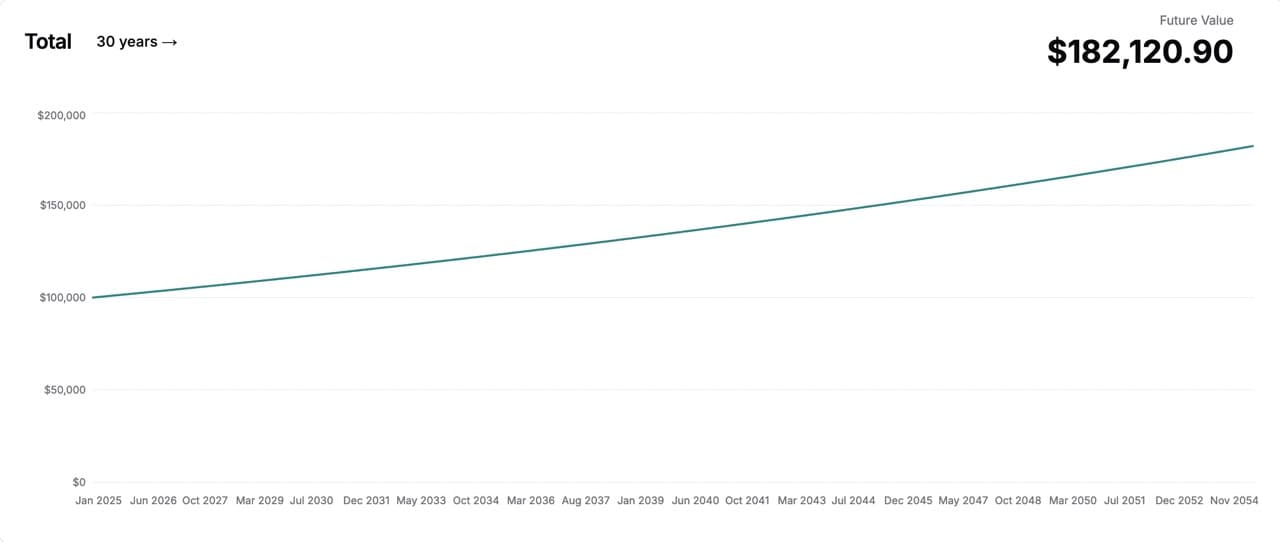

Say you had $100,000 in a savings account with a 2% growth rate. After 30 years, you would have ~$182,000.

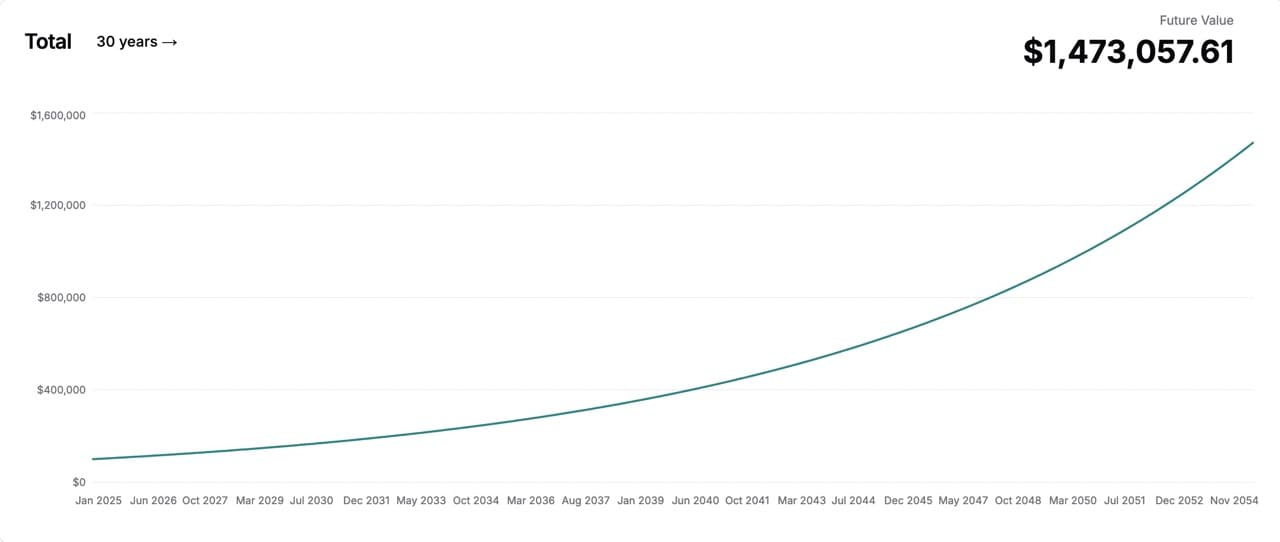

In that same 30 year period, if you had invested that $100,000 in the S&P 500 with a 9% return, you would have $1,473,000.

That's a difference of $1,291,000!

In one scenario you are a millionaire and in the other...

Be aware of the risks

While the S&P 500 has a great track record of consistent returns, it is not without risk. The value of the S&P 500 can and does fluctuate, sometimes dramatically.

Assuming a 9% return is also a bit optimistic. It is best to forecast returns with a variance which will capture a high and low bound of potential returns.

Additionally, the S&P 500 is heavily weighted towards sectors such as technology. If such sectors were to perform poorly, it could have a significant impact on the value of the S&P 500.

Sign up for CashSprout today to compare how your savings account would perform against different growth rates and monthly contribution amounts in the long run.