- Published on

How Investing Early Pays Off

Compounding interest might just be the eighth wonder of the world. It is a powerful tool that, if used correctly over a long period of time, can create generational wealth.

In this post, I'd like to highlight the importance of investing early and show how small contributions can dramatically grow over time.

Starting Early

The earlier you start saving and taking advantage of compounding interest, the better. This is of course obvious, but I think it is worth mentioning since time and time again people aknowledge the importance of starting early, but fail to do so themselves.

The best time to start investing was yesterday, the second best time is today.

Take The Following Scenario

- You start investing $300 a month at the age of 25 in an S&P 500 index fund like Vanguard's VOO

- You assume an average annual return of 8%

Note that 8% would actually be considered a fairly modest return as historically the S&P 500, including dividends, returns approximately 10% per year. This figure can vary significantly year-to-year due to market volatility

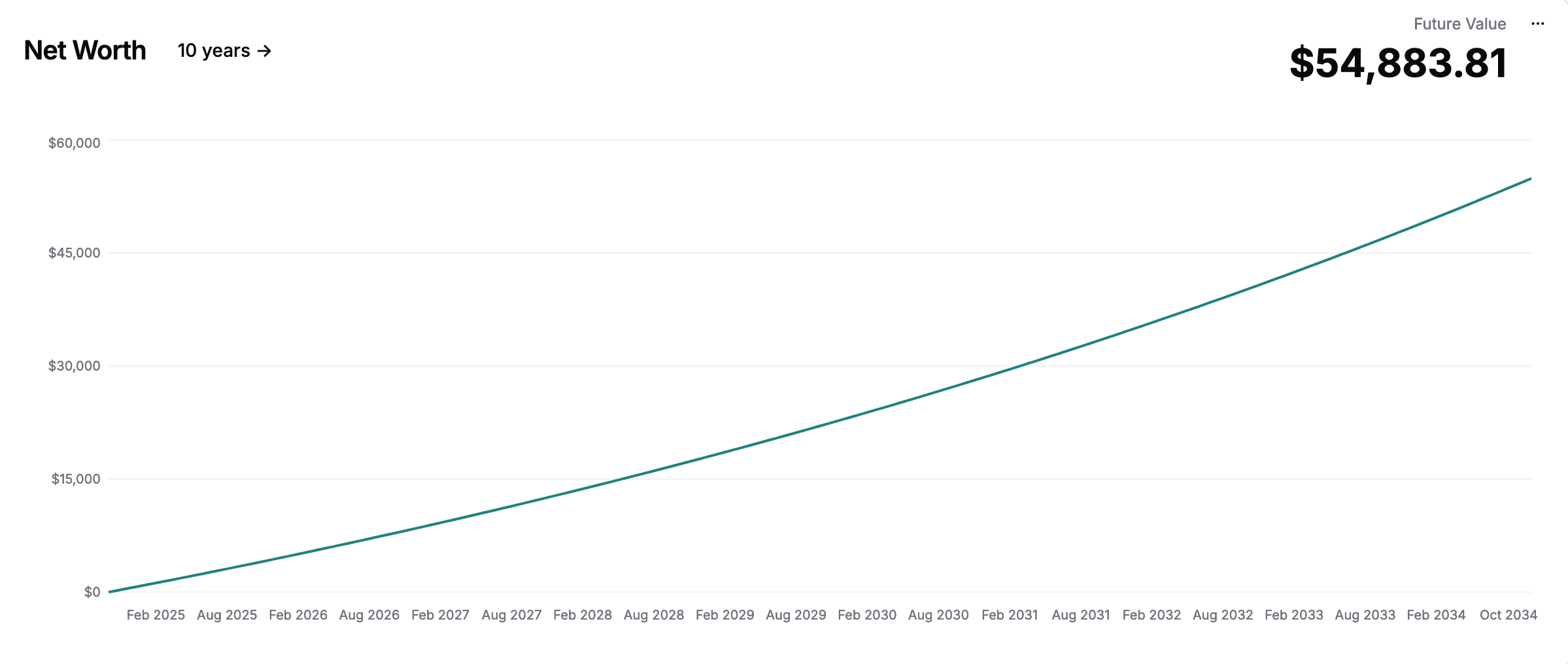

In 10 years

In just 10 years, you would have invested $36,000, but your investment would be worth ~$55,000.

That is a profit of $19,000 that you would NOT have gotten from simply storing your money in a savings account.

Investing in the S&P500 has it's ups and downs but if you are investing long term, you should be able to ride out the volatility. Savings accounts are a safe bet and are great for emergency funds for example, but they are not going to make you rich.

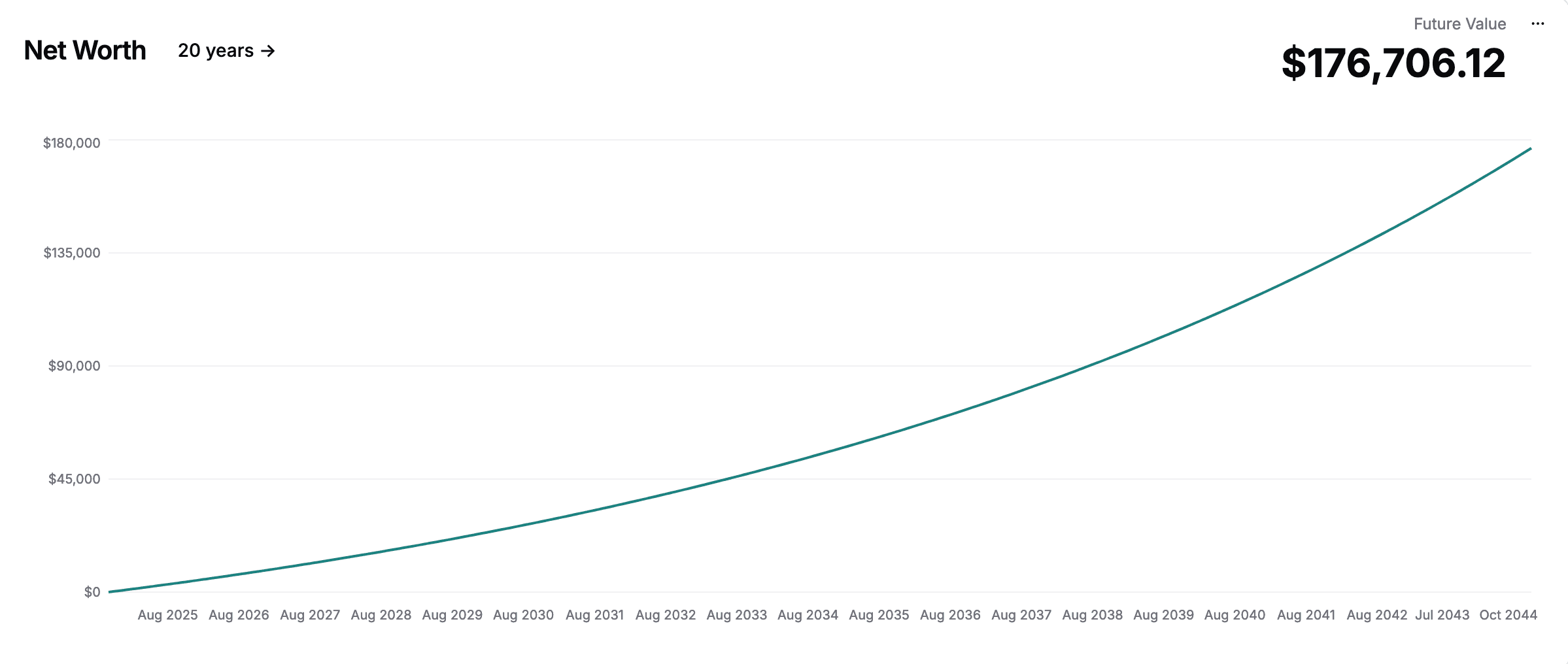

In 20 years

In 20 years, you would have invested $72,000, but your investment would be worth ~$177,000.

That is a profit of $105,000! More than most peoples annual salary...

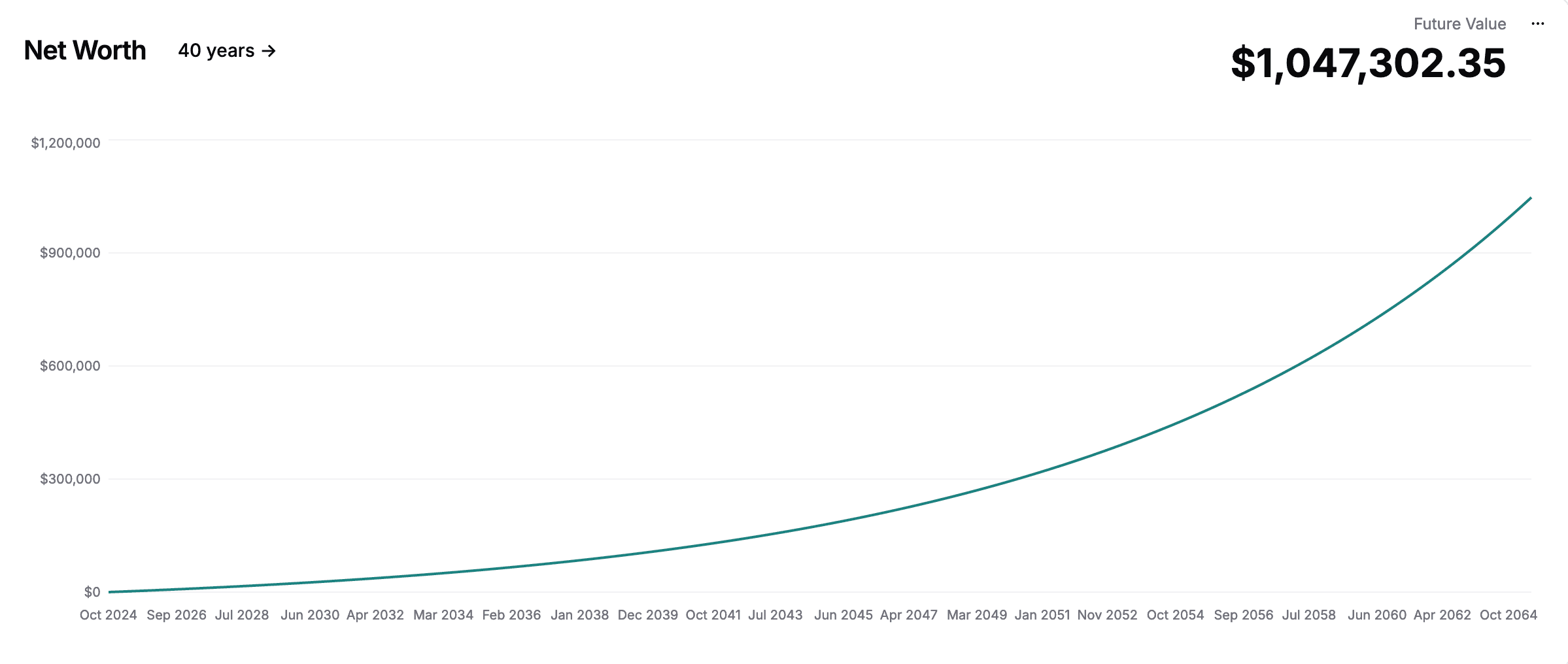

In 40 years

And finally, at the age of 65 (around the age most Americans retire), you would have invested $144,000, but your investment would be worth ~$1,047,000.

That is a profit of $903,000 🚀

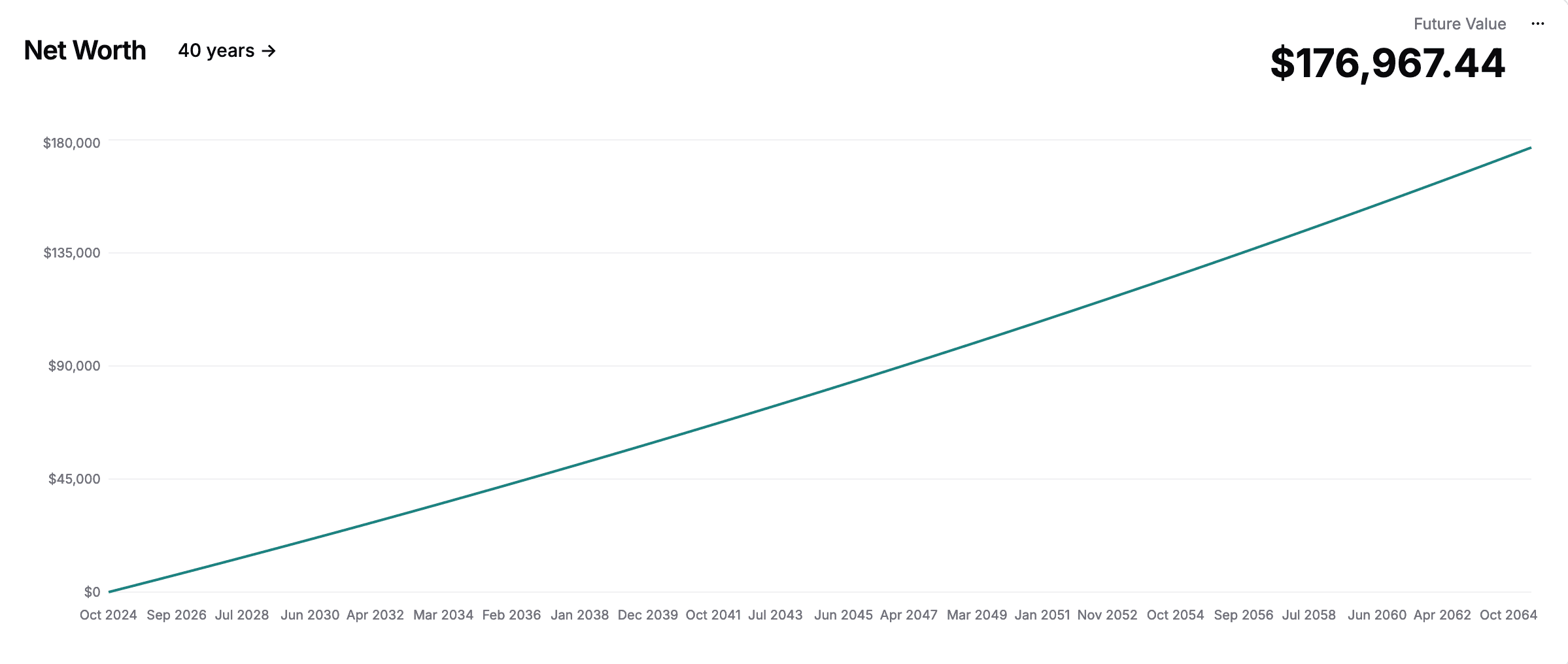

If you would have instead stored this money in a savings account with a 1% interest rate, you wouldn't even have $200,000 after 40 years...

That is almost exactly the same amount you would have had after investing in the S&P 500 for 20 years.

Conclusion

This is a simple example but it demonstrates how relatively small contributions can help you hit what so many view as an impossible milestone, becoming a millionaire.

There are some people who are unable to invest early due to financial constraints, and that is completely understandable. However, if you are able to invest early and choose not to, you are doing yourself a disservice.

For most of us, there is no "get rich quick" scheme. Instead, we must rely on patience and the power of compounding interest to slowly build our wealth over time.

Sign up for CashSprout today to compare how your savings account would perform against different growth rates and monthly contribution amounts in the long run.