- Published on

Bank of America Advantage Savings versus Ally Savings

Bank of America Advantage Savings versus Ally High Yield Savings

You may have been asking yourself: "Is a high yield savings account (HYSA) worth it?"" Our answer is generally, yes.

Bank of America, at the time of writing, offers a measly 0.01% standard APY on their savings account. Ally Bank, at the time of writing, offers a 3.8% APY on their HYSA.

This is a significant difference in the amount of interest you can earn on your savings. Allow us to demonstrate how this difference drastically impacts your savings over time.

Scenario

To compare the two savings accounts, consider the following scenario:

- You have two savings accounts, both of which have a starting balance of $1,000

- You contribute $250/month to each account

- You're Ally savings account has an interest rate of 3.8% APY.

- The Bank of America Advantage Savings account has an interest rate of 0.01% APY.

- Preferred Rewards members get access to an APY as high as 0.04% APY (lol)

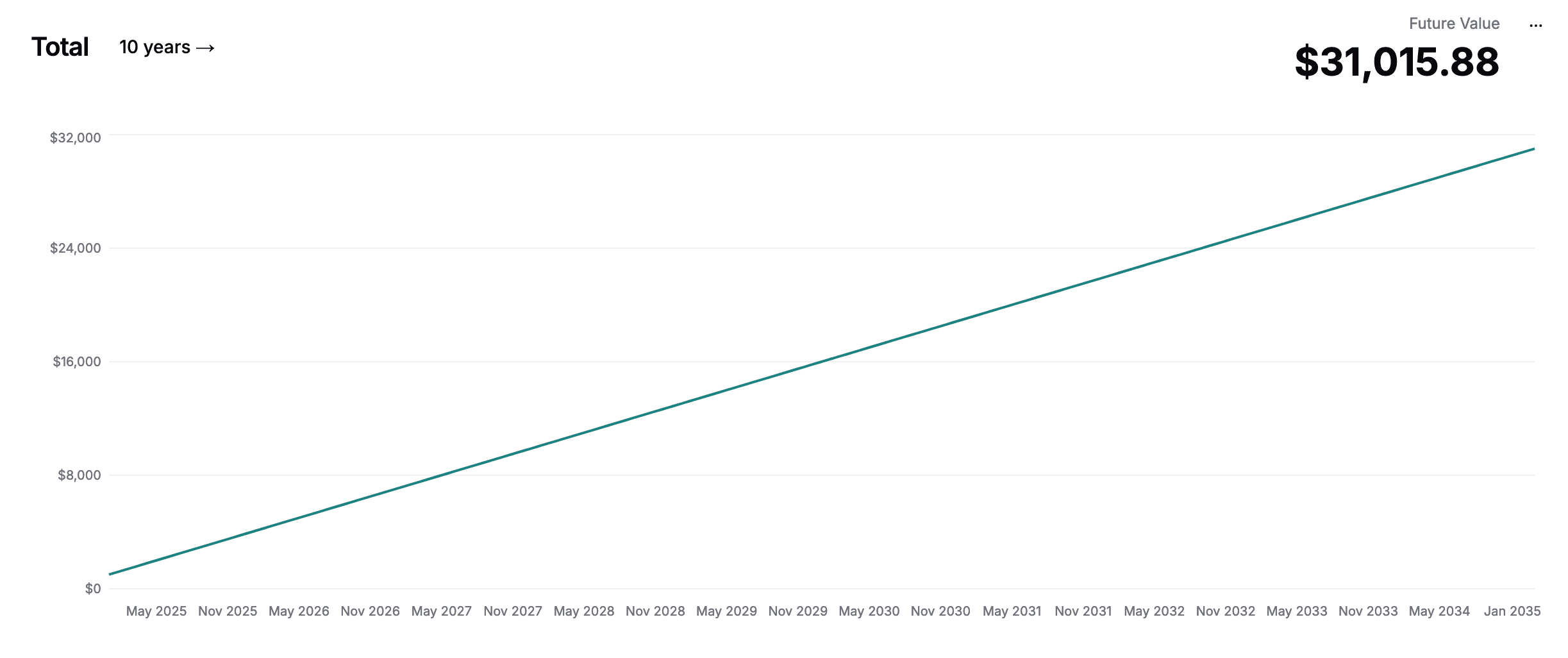

Bank of America Advantage Savings Account

With a starting balance of $1,000 and a monthly contribution of $250, the Bank of America Advantage Savings account would have the following balance after 10 years:

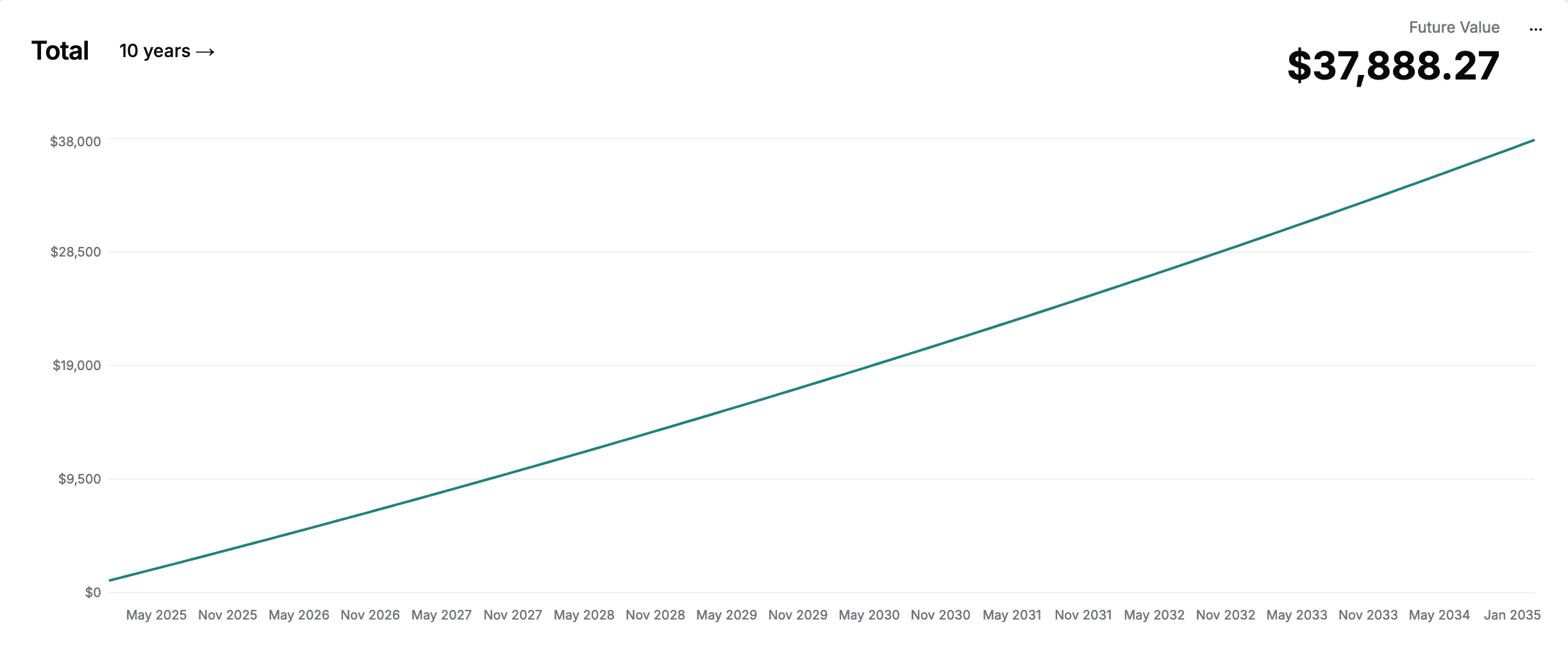

Ally High Yield Savings Account

The Ally HYSA would would have the following balance after 10 years:

Continuing the Scenario

After 10 years, the Bank of America Advantage Savings account would have a balance of ~$31,000. The Ally High Yield Savings account, on the other hand, would have a balance of ~$38,000. A gain of $7,000 isn't half bad, but this effect continues to compound over time.

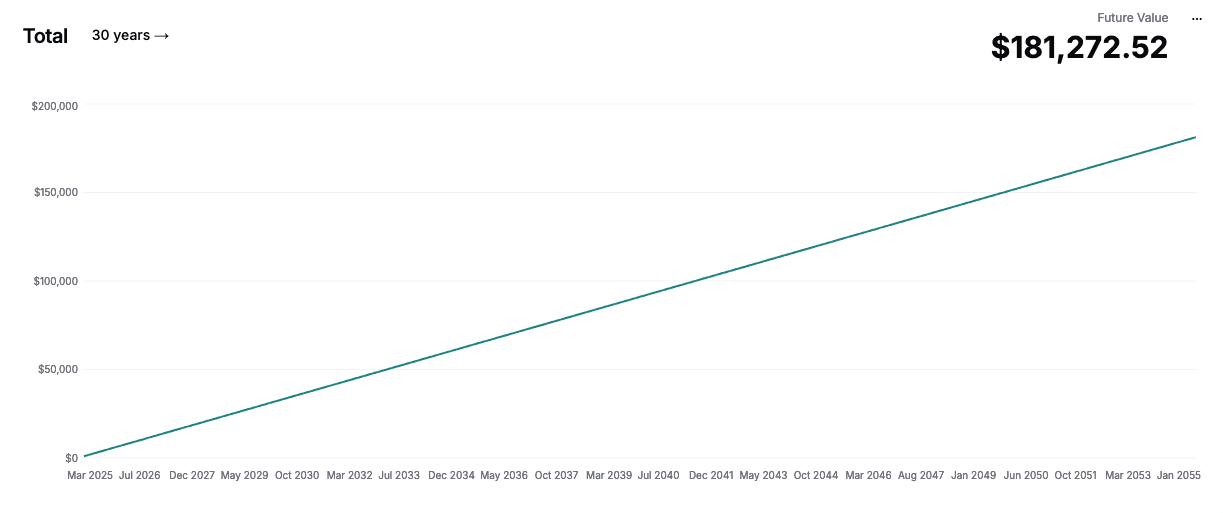

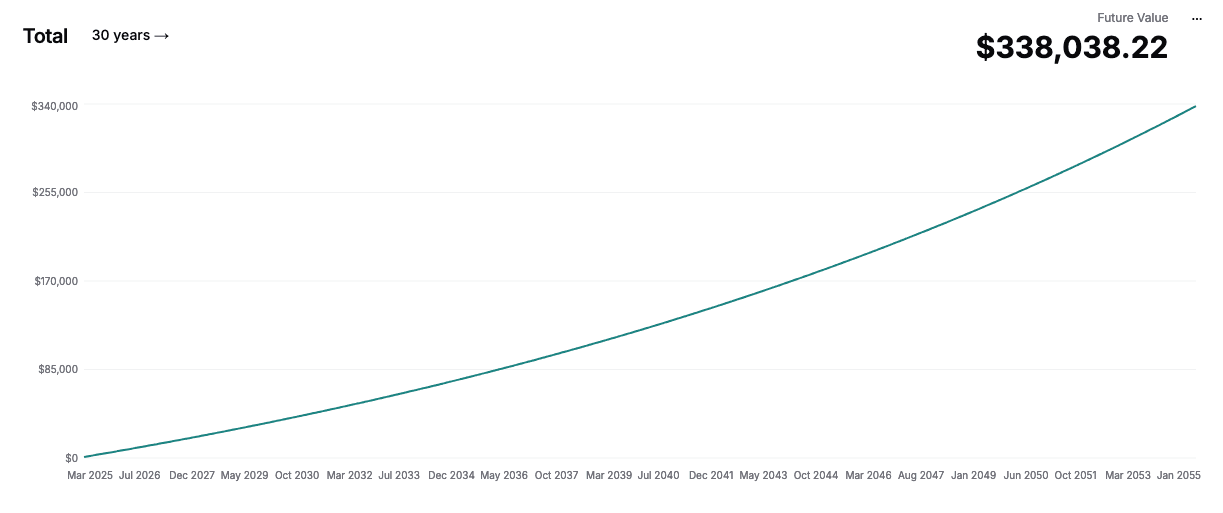

Look how much the difference grows when we change the contribution amount to $500/month and extend the time frame to 30 years:

Bank of America Advantage Savings Account

With a starting balance of $1,000 and a monthly contribution of $500, the Bank of America Advantage Savings account would have the following balance after 30 years:

Ally High Yield Savings Account

The Ally HYSA would have the following balance after 30 years:

That's almost DOUBLE the amount of money you would have if you had chosen the Bank of America Advantage Savings account.

Conclusion

These scenarios represent the effect of compounding interest over time. Generally, if you don't plan to make frequent withdrawals and have enough to save, choosing a high yield savings account is the way to go.

However, there are still reasons why one might want to choose a lower interest, non HYSA account. For example, Bank of America has many ATMs throughout the country that make it much easier to access your money. Additionally, if you already have a Bank of America account, it may be easier to manage your finances if you keep all of your accounts in one place.

Sign up for CashSprout today to compare how your savings account would perform against different growth rates and monthly contribution amounts in the long run.